Floor Perps

Aug 31, 2021 | Dave White

Contents

Overview

This paper introduces the floor perpetual, a synthetic NFT that tracks the floor price of a given project and can be minted by locking up NFTs from that project.

Floor perpetuals give NFT holders access to liquidity and protection against fluctuations in the floor price without requiring them to give up ownership of their NFTs.

As full-fledged perpetual futures (see The Cartoon Guide to Perps), floor perps also provide other market participants with leveraged long and short exposure to NFT floor prices.

Motivation

The Problem

Imagine you own ten Ocelots from the extremely popular Awful Hot Ocelots project (which I just made up).

You picked your Ocelots because you recognized in them certain aesthetic qualities not present in the other Ocelots in the project. While your Ocelots have all historically traded close to the project's minimum price, or floor, you believe their value will appreciate relative to the floor over time.

Recently, the floor price has risen dramatically, and your Ocelots represent the majority of your net worth. You love them and absolutely do not want to sell them, but would like some liquidity and protection against future declines in the floor price.

If you held just one extremely rare Ocelot, you could fractionalize it on fractional.art. But your Ocelots are not yet recognized to be that special, and you suspect you would have a hard time sourcing liquidity if you were to try to fractionalize all ten of them and sell shares of each.

Besides, you believe your Ocelots are underpriced relative to the floor, and do not want to give up any of their relative upside by selling even a fraction of them.

The Solution

You decide to use your Ocelots as collateral to create and sell OCELOT floor perps.

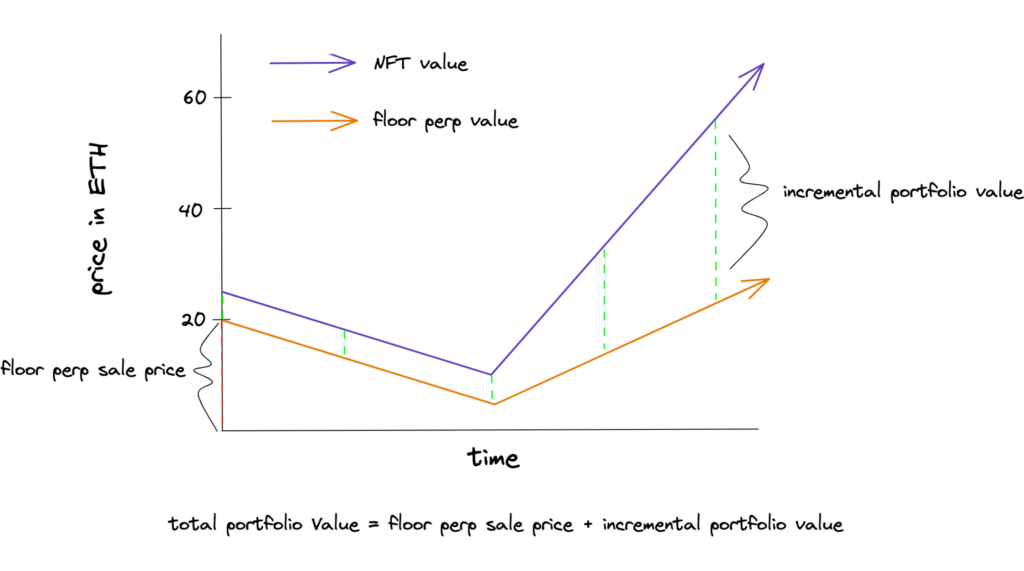

For example, let's say the Ocelot floor is currently at 20 ETH, and your Ocelots are worth an average of 25 ETH each, for a total portfolio value of 10 * 25 = 250 ETH.

You open up your web browser and navigate to a floor perp marketplace, where you lock your ten Ocelots as collateral. You then mint ten OCELOT perps, valued at 20 ETH each, and sell them to a market maker for a total of 200 ETH. The market maker will in turn sell your perps to traders who want exposure to the Awful Hot Ocelots project.

If the Ocelot floor later drops to 10 ETH, you can buy back all ten perps for 100 ETH (ignoring funding) for a net credit of 100 ETH, allowing you to recover your NFTs. If your Ocelots dropped 10 ETH with the floor to an average of 15 ETH each, you would now have 100 ETH and a portfolio of NFTs worth 150 ETH in total, for a total portfolio value of 250 ETH, just as if the floor had never fallen.

On the other hand, if the Ocelot floor rises to 30 ETH, you would need 300 ETH to buy back your perps and recover your NFTs, for a net debit of 100 ETH. However, if your thesis was correct and your NFTs have risen relative to the floor, say, to 65 ETH each, your total position would now have a value of 650 - 100 = 550 ETH, for a total gain of 550 - 250 = 300 ETH.

Funding and Liquidation

Like all perps, floor perps rely on funding, regular payments made between longs and shorts, in order to stay in line with their underlying.

If more people want to go long OCELOT perps than want to go short, Ocelot holders who sell perps agains their Ocelots will actually earn yield for doing so. This may well be the case, as longs can use leverage when buying perps and might pay a liquidity premium for the ability to enter and exit positions easily.

However, if more people want to go short than long, then shorts, including NFT holders, will have to make a periodic payment ("funding") to longs. Failing to pay funding is the only way Ocelot holders can get liquidated: because of design considerations we describe below, fluctuations in the NFT floor or the perp price will not lead to liquidation unless they cause massive funding payments, which implementers must be careful to avoid.

Mechanism

Overview

For a basic guide to perpetual futures mechanics, see The Cartoon Guide to Perps.

Floor perpetuals are just standard perps that track the floor price of a given NFT project, but with a few key modifications to allow NFT collateralization and to minimize NFT liquidations.

In particular:

- In addition to cash, shorts can collateralize their positions using an NFT from the project the perp is tracking.

- Shorts are required to pay funding in kind (see below) if they have insufficient cash balances.

- Shorts are liquidated based on the index price rather than the mark price.

- Long leverage requirements may be adjusted to ensure liquidity of the system.

Trading Venue

Like all perps, floor perps need a native venue. This could be an off-chain central limit order book or an on-chain AMM.

As Dan and Hasu like to point out, floor perps could even be implemented using a system like Maker.

Mark Price

As always, the mark price of the perp is its price on its native exchange.

Index Price

The index price of a perp is the price of the asset it is supposed to track.

In the case of floor perps, this price is the floor price for the project the perps are tracking, defined here as the highest price the market is willing to pay to get an NFT from the project without knowing which NFT they will get in advance.

As a first step, we might use a protocol like NFTX or NFT20 that issues fungible tokens representing a share in a basket of NFTs. Users can create these tokens by depositing an NFT or redeem them to withdraw an NFT. The price of these fungible tokens on a DEX, perhaps adjusted for liquidity, therefore represents a binding bid for the project floor.

Index Reliability

Illiquid floor NFT markets and volatile index prices are likely the largest barriers to making floor perps a reality, as the market for floor perps may grow to be many multiples of the size of the present market for the underlying floor NFTs. An unreliable index could increase liquidation risk, inaccurately represent collateral liquidation value, or become an attractive target for manipulation.

To fix these problems, a floor perp protocol would likely have to figure out not just how to better measure floor prices, but also how to actually improve liquidity in the spot floor NFT market. One possibility for a growing floor perp exchange would be to somehow incentivize participation in a local spot floor NFT exchange.

Funding

Funding for floor perps follows the standard formulation: once per funding period, say, daily, longs must pay shorts MARK-INDEX, most likely denominated in ETH.

NFT Collateral

Most perps are collateralized using cash margin.

In the case of floor perps, we allow those who are short the perp to collateralize their position with an NFT from the project instead of with cash.

Funding in Kind for NFT-Backed Shorts

In order to guarantee longs will be able to get liquidity when they close their positions, we cannot allow NFT-backed shorts to accrue cash-denominated funding debt (although a more intricate system might allow this in certain situations). Instead, if shorts must pay funding to longs and do not have a positive cash balance, the system will have them pay funding "in kind" to longs in the form of additional perps.

For example, imagine MARK is 10 ETH and INDEX is 10.2 ETH at funding time, so that shorts must pay longs INDEX-MARK = 0.2 ETH. Imagine Alice is short 0.5 perps, collateralized by an NFT, and she has 0 cash balance in the system. Then, instead of lending to Alice or liquidating her, the system will mint an additional 0.01 perps (since FUNDING/MARK*pos=0.2/10*0.5=0.01) or her behalf, so that she is now short 0.51 perps. It will then distribute the additional long position amongst the longs in lieu of cash funding.

In the example above, if Alice had been short 0.985 floor perps already and the system had to mint roughly an additional 0.01 perps on her behalf, so that she was now short 0.995 perps, she would be dangerously close to underwater and the system might liquidate her depending on its liquidation parameters. This is the only way in which NFT-backed shorts can get liquidated, as we explain below.

Liquidation Criteria for NFT-Backed Shorts

Imagine Alice has deposited an NFT as collateral and gone short

Her cash balance,

Her collateral, the NFT, is worth the current index price

In the standard perp formulation, Alice is underwater if her liabilities exceed her collateral and cash, that is, if

In this case, Alice could be liquidated any time the mark

So, rather than liquidating Alice based on the mark price

As mentioned above, we never allow Alice's cash balance

Absent extreme divergence between index and mark price, which is possible depending on implementation, this should be a rare and foreseeable event, giving Alice plenty of time to recollateralize her account if necessary.

Of course, there is a tradeoff involved in this design choice: if the mark is above the index price when NFT-backed shorts are liquidated, the proceeds of those liquidations, which can take place at or even below the index price, may not be sufficient to cover the shorts' obligations, which are denominated in the mark price, and longs will therefore not get all they are owed.

This will present a major discrepancy only when the mark price is far above the index price, which should be a relatively uncommon occurrence in a well-implemented system. This is because, as demonstrated in the Everlasting Options paper, a perpetual future is equivalent via no-arbitrage to a basket of expiring futures, which are themselves equivalent via no-arbitrage to a basket of bonds and physical NFTs.

Regardless, if this tradeoff presents too great a risk, this feature can be removed at the cost of increasing the risk of NFT liquidations.

Liquidating NFT-Backed Shorts

If NFT-backed shorts do have to be liquidated, their NFTs will be auctioned off, with the proceeds used to buy back their short positions and any overage going back to original holder of the NFT.

A partial liquidation executed by selling a fraction of the NFT using a service like fractional.art may be possible as well.

Voluntary Liquidations

In some situations, the floor price of a project may have risen so much that an NFT-backed short lacks the capital to buy back their perps and redeem the NFT. In such a case, the short may trigger a "voluntary liquidation auction," perhaps involving a fractional sale, to cover their debt and recover the overage. Since there is no risk of insolvency, such auctions may have more lenient parameters than typical liquidation auctions.

Liquidity and Dynamic Collateralization Requirements

Allowing shorts to collateralize their positions with NFTs instead of cash can expose the system to liquidity problems in certain circumstances.

For example, imagine Alice sells one perp using one NFT as collateral, which Bob buys at a price of 1 ETH. The price of the perp then jumps to 6 ETH. Bob is ready to take 5 ETH of profits on his long, and Charlie would like to buy in.

Now, if the protocol allowed Charlie to buy at 2X leverage, he would only need to deposit 3 ETH. However, even if Alice hadn't withdrawn any ETH from her original sale, Charlie's 3 ETH deposit plus the 1 ETH already in the system adds up to only 4 ETH, not enough for Bob to take his 5 ETH profit from his sale.

As a result, whenever the system is undercapitalized, we will increase the collateral requirements for new buyers in order to ensure adequate liquidity for sellers.

The most basic method would be to require buyers to fully collateralize their purchases whenever the system is undercapitalized. For example, in the situation above, this means Charlie would have to pay a full 6 ETH to open a long position, so that there would then be a total of 7 ETH in the system and Bob could claim his full 5 ETH profit.

More complicated schemes are possible and might offer a better user experience. For example, the system might gradually increase collateral requirements as it becomes less capitalized instead of abruptly switching.

Next Steps

As mentioned above, the biggest problems aspiring floor perp protocols will have to solve are index reliability and spot NFT floor liquidity. Given good solutions, the possibilities are endless.

For example, if we can find an appropriate index, we can create perpetual markets not just for a project's floor, but for NFTs containing a certain attribute or mix of attributes. We may even be able to split NFTs into synthetics representing their component parts and recombine them into new synthetics representing certain theses.

The core liquidation mechanism can also be used for other products, such as instant NFT-backed loans. And, of course, the framework can be trivially adapted to offer everlasting covered call options on NFT floors.

If you are interested in moving the conversation forward, I would love to hear from you. You can email me at dave@paradigm.xyz or DM me on Twitter.

Acknowledgments: Dan Robinson, Matt Huang, Kevin Pang, Georgios Konstantopoulos, Sam Sun, Anish Agnihotri, Jim Prosser, Reena Jashnani-Slusarz, Grug, Lily Francus, WSBMod, 0xSisyphus, Mewny, FJ, Hasu, Andrew Badr, 0xbunnygirl, Omar Bohsali, Alex Wice, Bartosz Lipiński, Teo Leibowitz, Tarun Chitra, jhl, andy8052, Big Magic, 0xElm0, Jordi Alexander, shema, David Lu

Disclaimer: This post is for general information purposes only. It does not constitute investment advice or a recommendation or solicitation to buy or sell any investment and should not be used in the evaluation of the merits of making any investment decision. It should not be relied upon for accounting, legal or tax advice or investment recommendations. This post reflects the current opinions of the authors and is not made on behalf of Paradigm or its affiliates and does not necessarily reflect the opinions of Paradigm, its affiliates or individuals associated with Paradigm. The opinions reflected herein are subject to change without being updated.