Evaluating Web3 job opportunities like an investor

Jun 07, 2022 | Devon Lloyd

Let’s say you’re a candidate with job offers from a handful of startups. Each one looks great on the surface: sleek website, successful founders, strong early team, and name-brand investors. At some point, you need to make a decision: which one will you join?

The decision process is one that mirrors what an investor might go through when evaluating investment opportunities. Both decisions have a similar end goal: maximize your return, not just financially, but across several metrics that enable you to grow and be positioned for even bigger opportunities later on.

To make the decision, an investor, through the process of due diligence, will look at both the qualitative and quantitative aspects of an opportunity. It stands to reason that you, as a candidate, should do the same.

Some qualitative characteristics, like the team, might be evaluated the same way in Web2 as in Web3: pedigree, references, interviews, and chats with previous investors. You have to decide based on your qualitative experiences which job presents the best culture fit, where you feel you can thrive, contribute, and learn from those around you.

But where things start to differ in Web3 are a candidate’s access to previously (in Web2) inaccessible quantitative metrics of early-stage opportunities.

Investors have long enjoyed access to the quantitative metrics of private companies, giving them signals to understand a business’s current state and long-term potential. Prior to Web3, these generally were not accessible to a job candidate, even one with an offer in hand. These metrics were usually closely guarded secrets, except when disclosures are mandated by law or regulation. Were you, as a candidate, to ask for them, you would likely be told “no” and be asked instead to trust them.

But as we said, in Web3, things are different.

Even in early-stage opportunities, the quantitative metrics that might help with your decision are, by default, publicly available on-chain. Whether you’re curious about growth, revenue, transactions, or retention, with a bit of understanding, consideration of context, and the right tools, a protocol’s user activity, and core business metrics are freely available.

Want to understand how many daily active wallets interact with a protocol? Search the name of the protocol on Dune Analytics and pull up a dashboard or two. Want to see what a decentralized exchange’s transaction volume looks like? Use a free tool like Coingecko.

The metrics you might care about will vary from company to company and vertical to vertical, but the data is there if you want to find it. Web3 is offering the ability for you to select a job opportunity not based on trust alone, but with the open book that was previously the sole province of investors.

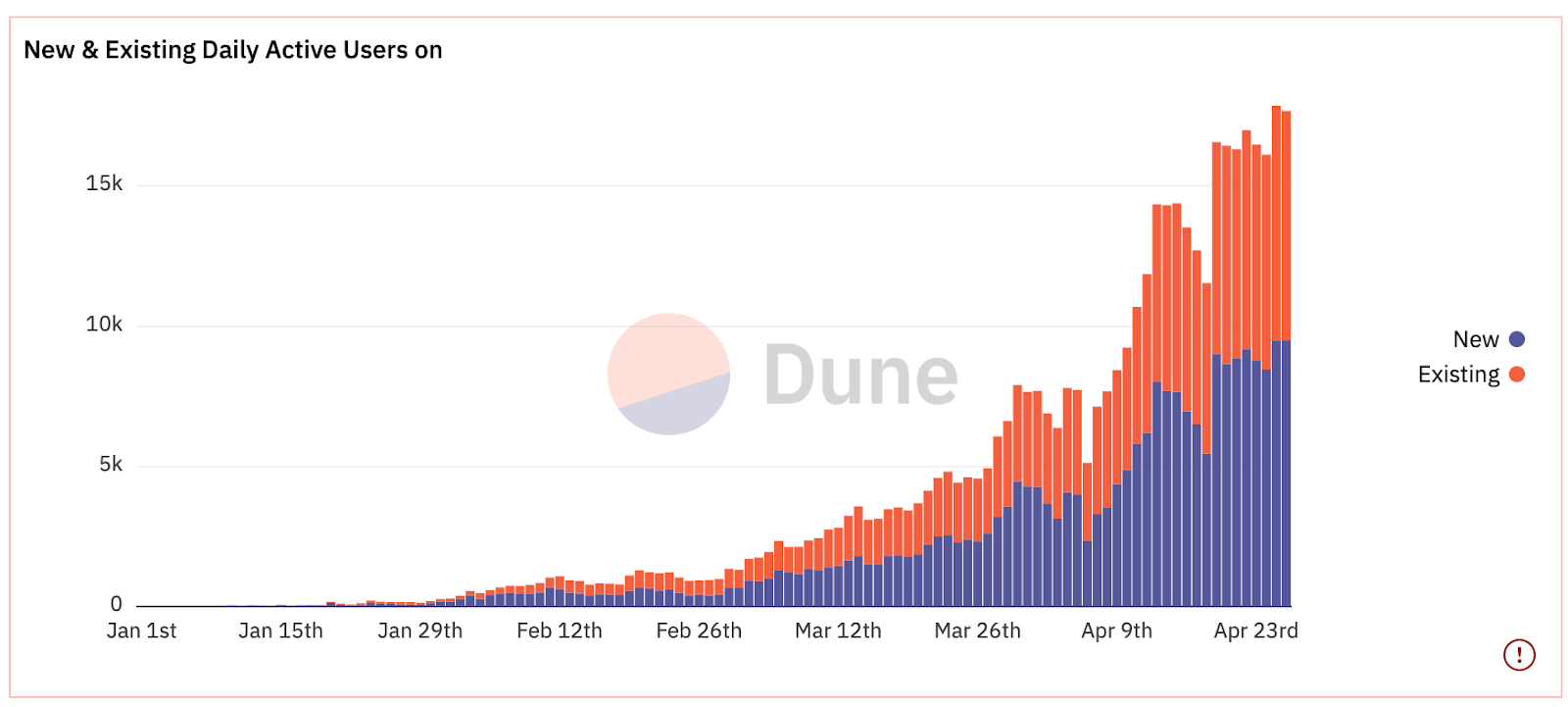

Example chart of a Web3 project that grabs public on-chain wallet data to display new and existing Daily Active Users

Example chart of a Web3 project that grabs public on-chain wallet data to display new and existing Daily Active Users

It’s important to note, as with anything data-related, context is everything. Sometimes metrics can be misleading. And at times a project’s nuances can be set up to incentivize unusual activity. For example, a retroactive airdrop could induce one-to-many user-to-wallets to interact with the protocol, skewing some reporting. Just like an investor would, ask yourself critical questions about why the numbers are what they are. Seek a second opinion from someone you trust, or ask the company making the offer what their take is.

In many cases there are pre-built crowdsourced dashboards that can help you find this information, so even if you’re non-technical you still have access. With a little bit of SQL knowledge, you can dig a click deeper and build those dashboards yourself. On the other side of the table, if you’re a founder, consider creating resources to visualize on-chain data that might make a compelling case for candidates, and share them proactively.

On that note, just as data can be a tool for job seekers, it can also be a tool and competitive advantage for founders to help land employees. Transparency makes founders’ lives easier by reducing the need for candidates to take a leap of faith. Reducing the need for blind trust and replacing it with clear data can have knock-on effects across the entire company. When candidates have access to meaningful information about company performance, they can walk in the door on their first day with high confidence in the team and the project. If you’re reading this as a founder rather than a job seeker, consider the impact you can have on your company by including transparent data and metrics as part of your recruitment practice.

When the entire company, and even prospective employees, have access to data that show how the business is performing, everyone is incentivized to think about their role not merely as employees, but as owners, and investors.

If you're looking for a new role in crypto/Web3, we'd love to help you find it: talent.paradigm.xyz.

Disclaimer: This post is for general information purposes only. It does not constitute investment advice or a recommendation or solicitation to buy or sell any investment and should not be used in the evaluation of the merits of making any investment decision. It should not be relied upon for accounting, legal or tax advice or investment recommendations. This post reflects the current opinions of the authors and is not made on behalf of Paradigm or its affiliates and does not necessarily reflect the opinions of Paradigm, its affiliates or individuals associated with Paradigm. The opinions reflected herein are subject to change without being updated.